Following the 2023 Autumn Statement earlier this week, we’re reflecting on the announcements to try and shed some light on how our mortgage brokers and protection advisers might be affected. With its major impacts on household budgets, tax adjustments and the general landscape of the UK economy, the Autumn Statement is always a much-anticipated event. Despite disappointment that the property market has been overlooked, there is a silver lining regarding the Mortgage Guarantee Scheme which you can learn more about here.

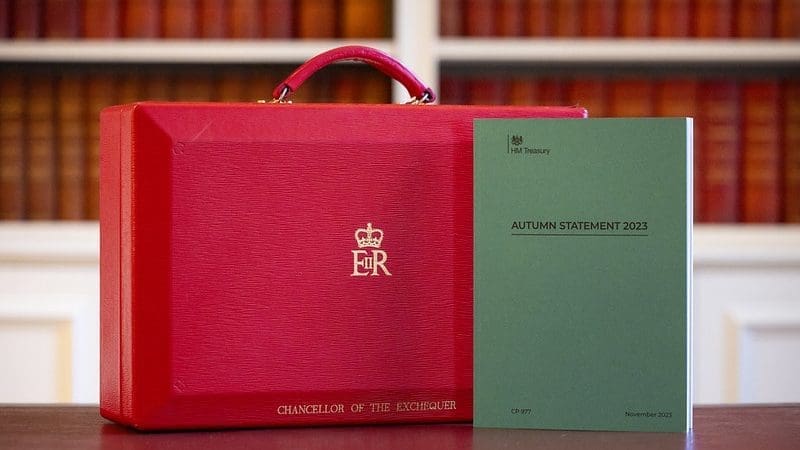

What happened at the 2023 Autumn Statement?

Here’s a recap of the key changes announced by the Chancellor of the Exchequer, Jeremy Hunt:

NATIONAL INSURANCE TAX CUT

In a change set to benefit around 28 million UK residents, The news that national insurance will be cut by as much as 2% has been one of the major stories of the Autumn Statement.

Prior to this decrease, the main rate for British workers was set at 12% the reductions which will come into effect as of the 6th of January can not only benefit your own pockets but will see more money in the economy, more take home pay for clients, more potential savings and more all important affordability for lending and protection needs.

MINIMUM WAGE HIKE

Possibly one of the most significant changes is increase to the national living wage, the jump from £10.42 per hour to £11.44 per hour represents a significant boost to the economy as a whole, but brokers in particular can be excited about this change. This increase will be a huge help to first-time buyers, and other aspiring homeowners. The higher minimum wage can ease concerns of budgeting while also encouraging workers to put away extra savings for deposits and other costs associated with buying and owning a home for those who are yet to get on the property ladder this is a massive positive.

TAX BREAKS FOR BUSINESS

The decision to cut business taxes by extending the ‘Full Expensing’ incentive which was originally introduced in March 2023 has also been made. With this, businesses will now be free to invest in new equipment including IT tools and office machinery and deduct their costs from their yearly taxable profits. Smaller firms will also experience some rate relief which will mostly benefit hospitality businesses. As a protection adviser, if business insurance isn’t something you have previously been focusing on, now is the time to change that. Support your customers looking to sure up control of their business in the event of a key shareholder death or safeguard those who have taken out a business loan with the help of a partner, by paying closer attention to your business protection services which are sure to receive a few more inquiries now that owners are enjoying lower end of year costs.

STATE PENSION INCREASE

The triple lock, which ensures that pensions rise by the highest of average earnings, inflation, or a minimum of 2.5%, is crucial in safeguarding pensioners’ income.

After confirming their commitment to the triple lock Jeremy Hunt stated that this decision will be “one of the largest ever cash increases to the state pension” The increase from £203.85 per week to £221.20 increases guaranteed income by £900 a year. This 8.5% increase could be vital for later life clients, this area of the market frequently sees affordability challenges, and this will go some way to supporting this demographic keep up with inflation and the cost of living, there are many ways later life clients can utilise housing wealth to support their income and ensure any care needs are met, all that start with a conversation with a broker. Our panel includes a range of later life lenders, allowing you to fully support you customers’ requirements throughout their lifetimes.

To support PRIMIS brokers, we have created a handy summary document and customer letter based on the Autumn Statement. Want to be part of a network that does that?

Begin Your Journey with PRIMIS