Consumer Duty represents perhaps the biggest shake-up to the financial sector in over a decade. With the intended role out date set for 31st July 2023, it won’t be long until we can see exactly which firms were able to prepare themselves for the new regulations, and which firms tried to cut corners. In preparation, most firms have taken a deep dive examining the way in which they engage with consumers and review their pre and post-sale processes. As you would expect, some firms are further along in the process than others.

Wherever your firm finds itself in this timeline, it always helps to know what it is you need to do to ensure you don’t breach the revised FCA (Financial Conduct Authority) regulations. In this article, you can find out exactly what Consumer Duty is, and what it means to your firm in terms of moving forward. We will also look to discuss some of the ways you might be able to minimise the impacts of Consumer Duty on your proposition, with help from us as a mortgage network.

What is Consumer Duty?

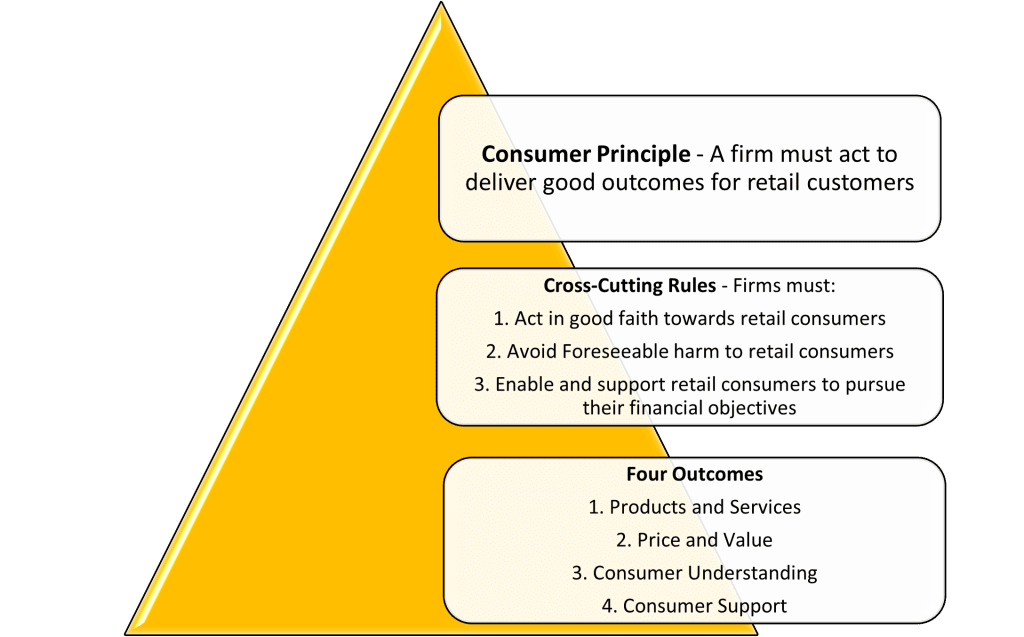

First, it might be worth just examining what Consumer Duty actually is. You’ve probably heard the term countless times since its announcement all the way back in July 2022, but you might still be scratching your head as to what its actual definition is. Well according to the FCA, Consumer Duty is a new precedent for firms to follow which ‘sets higher and clearer standards of consumer protection across financial services, and requires firms to put their customers’ needs first‘. So at its core, Consumer Duty ensures that firms and brokers aren’t able to take advantage of their customers with exploits designed to force them into paying for policies or arrangements that they do not need, nor can they afford.

The Four Outcomes of Consumer Duty

The Consumer Duty principle isn’t just a basic outline for firms to follow with no real structure in place. There are actually four specific outcomes listed by the FCA which you might have seen already, but may not be fully aware of their implications, which will provide you with specific areas of focus to determine how and where you meet the Duty requirements.

- Products and Services – The entire life cycle of a proposition accepted by consumers will have to be proven clearly that it is targeted to the specific demographic of said client.

- Price and Value – The associated worth/value of any product or service offered must be clearly evidenced and explained to any consumer, with any price changes implemented correctly to always reflect the potential outcomes for consumers.

- Consumer Understanding – Firms will be required to justify why their chosen method of communication with a specific demographic has been determined as suitable. Consumers should also be left without doubt as to what the product or service they are being sold offers for them in terms of value and benefits.

- Consumer Support – Similar to the previous outcome, Consumer support looks to have firms explain how their chosen method of communication is appropriate, and how the product or service they are communicating to a specific demographic is able to meet the needs you have identified.

How will the FCA enforce Consumer Duty?

The driving force behind the introduction of Consumer Duty is the FCAs commitment to protecting consumers from malicious, or simply inconsiderate firms. Obviously, most firms and brokers do act with their customer’s best interests at heart regularly, but unfortunately that does not apply to everyone, which is why the FCA has already put in place numerous measures to punish offenders guilty of breaking Consumer Duty practices. The FCA has actually stated that, due to their supervisory approach, the punishment of those who break Consumer Duty acts ‘will be proportionate to the harm – or risk of harm – to consumers with a sharp focus on outcomes‘.

The impact of Consumer Duty on Firms and Principals

It is unavoidable that Consumer Duty will have a huge impact on the financial service sector as a whole. Even if you feel, as an individual or as a firm, that you have been compliant with the Consumer Duty act before its main principles were ever compiled, there’s still a lot you need to do to ensure you can sufficiently evidence your compliance when called upon.

As stated by the FCA, a key component of the Consumer Duty act is that firms assess, test, understand, and then perhaps most importantly, evidence the outcomes their customers will receive as a result of their purchase of a product or service. They have also listed some of their expectations when it comes to their spot checks and monitoring of firm practices, which will provide some incredibly useful insight as we analyse our operations. Many firms have put together a Consumer Duty Implementation Plan, which can actually be externally validated by compliance teams, ensuring that they aren’t caught out once the July 31st start date comes around.

While the short-term changes forced upon firms may be somewhat of an inconvenience initially, the long-term benefits this offers to consumers will greatly benefit the financial services industry as a whole, which in turn will support individual firms. Consumers will no longer be uncertain of their broker or adviser, worrying that they are selling them unnecessary or overpriced policies, with the outcomes of the Consumer Duty act ensuring that any product or service must be thoughtfully and carefully explained in terms of the value and benefits it will provide. For firms that take the time to really develop an extensive Consumer Duty plan, the actual impact will be minimal but the benefits will be many. The same can’t be said for firms who are unprepared however, as they will not only suffer as a result of poor communication with their customers leading to strained relationships, but also in the event they are in direct breach of any Consumer Duty principles, leading to punitive measures being enforced by the FCA.

How PRIMIS will help our Firms prepare for Consumer Duty

As a mortgage network, we want you to know that you aren’t alone when it comes to preparing for any major overhaul to the industry. Making sure you are fully equipped to deal with the changing regulatory landscape is a priority here at PRIMIS, so while we persist with staying on top of the usual cycle of continuous improvement, we are also committing our efforts to a wide range of applications that will help you thrive in the post-Consumer Duty era.

As part of our mortgage network, we will be in constant communication via an array of channels including email, video, online meetings and more. This will provide us with the opportunity to keep our expectations aligned when it comes to consumer outcomes, which will maintain a sense of stability during this major cultural shift. The established processes and procedures within your practice will be challenged along the way, encouraging you to identify both problem areas and areas of success within your proposition, seeing which are fit for purpose in meeting these new standards. Those that are not can be tweaked or adapted so that you aren’t left with major areas of your product or service being inaccessible to your clients. Any customer-facing documentation will also be revisited to examine any content is accurate and compliant, whilst the tone is clear and concise so as not to blur the lines when it comes to ensuring customer understanding. PRIMIS will be totally and completely committed to keeping our firms notified during this period of change, proactively providing updates when necessary so that the benefits of working alongside us never stop.