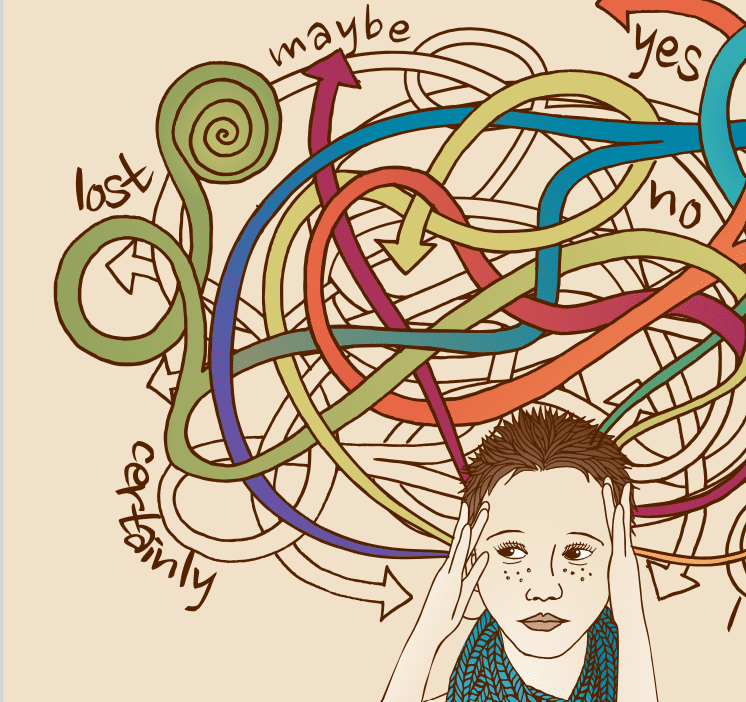

When you’re liaising with your clients, do they understand the language you use? Are you using complicated jargon only those in-the-know could possibly understand without a Google search at their fingertips?

Well, it isn’t just your clients who might be feeling baffled. Due to differing terminology used from one provider, bank or business to the next, advisers too are sometimes left scratching their heads.

THE RISKS OF TERMINOLOGY CONFUSION

In 2019, credit check provider Noddle reported 40 million UK adults are confused by money-related abbreviations and terminology.

- 77% of UK adults said they were confused by financial jargon.

- One in 10 lost out on favourable rates at the bank.

- 12% admit their credit score was impacted because they didn’t understand the terms and conditions on a financial agreement.

THE SIMPLE PRODUCTS INITIATIVE

A 2013 Sergeant Review, undertaken by a steering group led by FSA Managing Director Carol Sergeant, recommended the introduction of a “simple financial products badge for qualifying products via a robust accreditation process” (FT Adviser, Nov 14 2013).

The idea behind the concept was a vital step towards helping consumers understand what exactly they’re paying for. Simple in both name and nature, it was intended to:

- Help consumers compare products

- Easily understood and accessible products

- Consumer confidence the product would meet their basic needs

- Be a viable proposition for financial services providers

Difficulties identified with existing products included consumers being unable to identify ‘simple products’, inconsistent use of language and over-complicated products designed to cater for a range of situations.

It comes as no surprise it was found that “simple products should be easy to understand, buy, manage and compare, they should be fair, and they should be offered on a non-advice basis; that is they can be bought without needing specialist personalised advice.” (Fincap)

HOW CAN CHANGING THE LANGUAGE YOU USE BENEFIT YOUR RELATIONSHIPS WITH YOUR CLIENTS?

Those who work in the financial industry are, of course, very familiar and comfortable with throwing around intricate terms – interest rates, LTVs, risk, bridging loans… But if you frame your terminology into an easy to digest narrative i.e., put it into context without the use of complicated jargon, you can help your clients have a better understanding of the technical language you are used to, and in doing so, build a more solid foundation for long-term relationships.

If your client is confused about the topics you’re discussing, inevitably they will be more wary of what you’re offering – even if what you are advising is 100% in their best interest. Lack of understanding can breed mistrust, and if your client fails to trust what you’re saying (because they simply don’t understand it), they are probably going to run for the hills. That means you will have to spend more time and work harder at retaining business when you could be growing their accounts.

Fundamentally, your clients know what they’re looking for – financial stability and a secure, protected financial future. But they may not know how they can achieve it. Align yourself with your client’s goals, personalise your conversations; use their personal circumstances to introduce hypothetical scenarios that will put the product you’re advising into context. Doing so will foster faith in your guidance to achieve your client’s goals and keep them bringing business back to you.

Read the full document here