What is Toolbox?

Toolbox is PRIMIS’ own digital front-to-back office solution designed for brokers to use in the advice process with their customers, and to operate their businesses efficiently and compliantly.

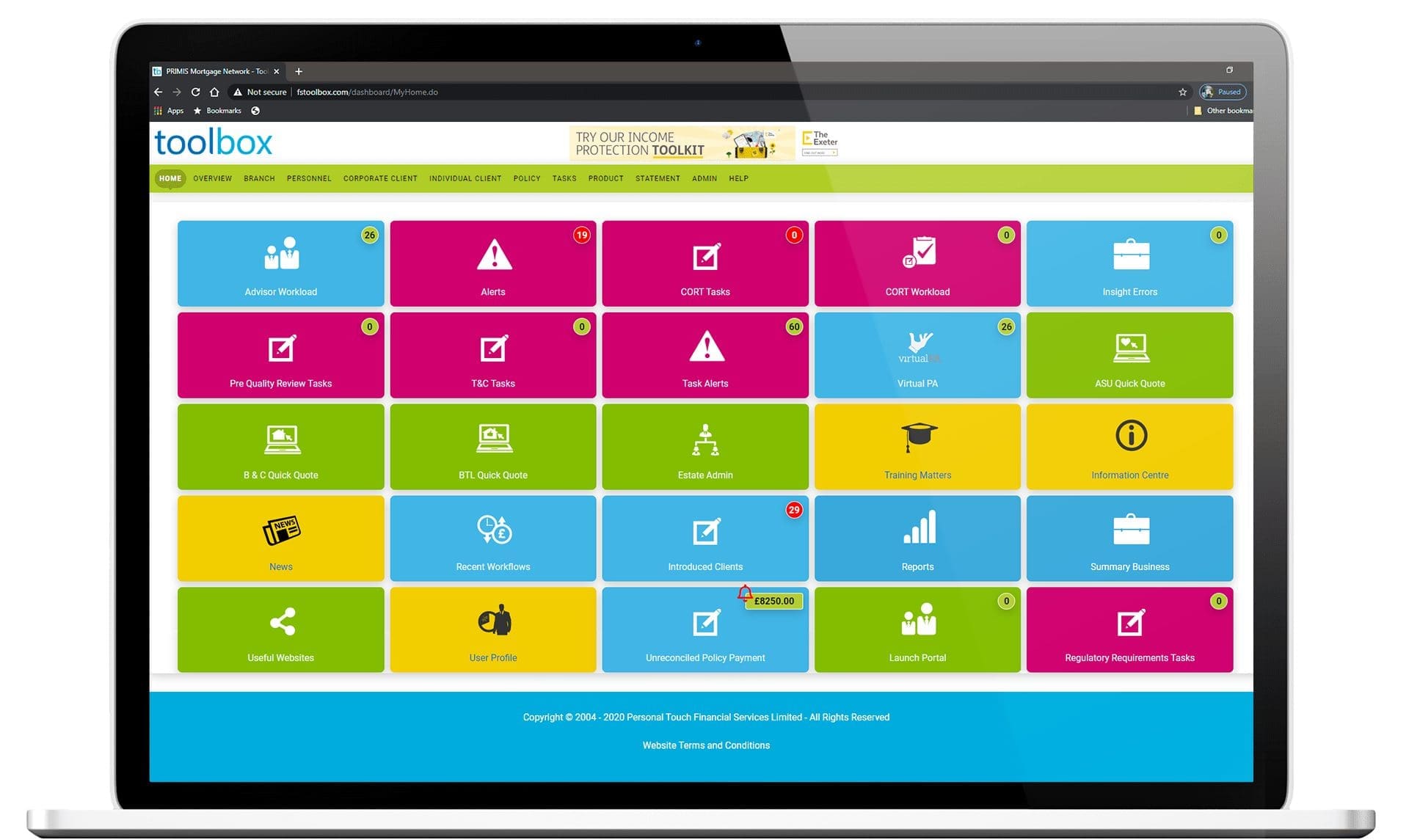

Toolbox provides PRIMIS mortgage and protection brokers multiple functions within one system (click to expand the sections below on the Toolbox home page to learn more). Here are some of the key areas of functionality used by brokers:

API connectivity developments give brokers access to industry-leading integrated solutions. These include mortgage sourcing, protection sourcing, general insurance (GI) quote engine, application submission, electronic ID and due diligence checking and customer feedback questionnaires.

How can it help your business?

PRIMIS want to give advisers the right tools for the job, so they can focus on their customers and grow their businesses. Toolbox is designed to streamline processes and make life easier for brokers and their customers. With so much functionality in one platform, it saves using and paying for multiple systems.

What makes

Toolbox unique?

As Toolbox is an in-house solution, it can be adapted quickly in line with market, lender and provider changes.

Intermediary feedback is gathered regularly to ensure that Toolbox delivers world class experiences for all users, in particular meeting customers’ needs.

As a purpose built technology solution, PRIMIS have full influence of direction for enhancements whilst ensuring user experience and data security is at the core of decision making. In essence, PRIMIS are not restricted by third party solution limitations – it is all our own making. Our approach means that brokers and their customers are at the centre of our technology.

Want to know more?

What they’re saying.

The numbers*

147,154

30,649

150,366

18.26

79,209

61,563

*July 2020 – June 2021

Your virtual PA.

Virtual PA is a lead generation tool PRIMIS built to help brokers spot gaps in their customers’ product portfolios. This tool identifies where protection and other insurances are missing, and intelligently identifies further opportunities with their mortgage products. This helps brokers maximise their client banks and helps to ensure that customers don’t miss out on the financial advice they need.

RECENT ENHANCEMENTS.

- Online engagement, live chat and secure document transfer through fully integrated Client Portal

- Online application portal for all onboarding of firms and advisers

- Online FCA Directory for customer insights.

A CLIENT PORTAL.

Our Client Portal is a fantastic tool to make the advice process smoother for both you and your clients.

- The Portal can be customised to your branding, personalising the experience and providing a professional interface.

- You can communicate with your clients quickly and easily via instant messaging.

- You don’t have to re-key data into the Fact Find or re-upload documents into Toolbox, as they can be transferred from the Portal automatically.

- You can have confidence that your clients’ data is protected, with secure logins via two factor authentication.

- Multiple interactions can take place between advisers, administrators and clients, so everyone is involved throughout the journey and can offer fantastic service to clients.

API INTEGRATION.

Our API integration capability means that we can partner with industry-leading solutions, delivering a better experience for you.

- Provides efficiency, lowers cost and reduces re-keying to make life easier for you.

- Full data encryption is used for protection and peace of mind.

- Only the right people access the right data with authentication and authorisation processes in place.

- It is scalable cloud-based technology, so we can keep developing for the future.

Ready to begin your journey with PRIMIS

Over 2,800 brokers enjoy the benefits of being part of the PRIMIS Mortgage Network. If you’d like to learn more about how your firm could reap the rewards too, please complete this brief contact form and we’ll be in touch to see how we can help you.